Name Three Activities You Might See at Reserve Banks.

Reserve banks also supervise commercial banks in their regions. The function of reserve requirements is described in the Federal Reserve publication Purposes and Functions.

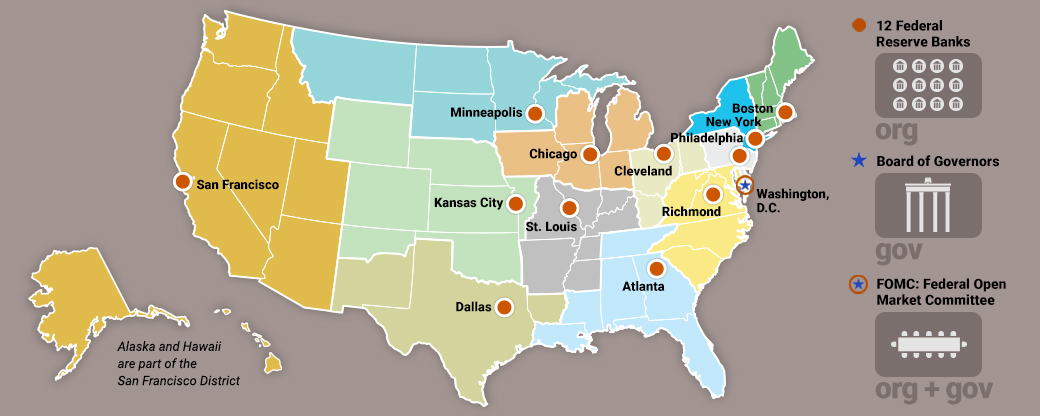

Understanding The Federal Reserve Banks

The Federal Reserve is the central bank of the United States.

:max_bytes(150000):strip_icc()/dotdash_Final_WhatDo_the_Federal_Reserve_Banks_Do_May_2020-01-08af2fa345a440ff9df4c83495ad4328.jpg)

. Credit unions are similar to banks but they are not-for-profit organizations owned by their customers. For example lets assume that Bank XYZ has 400000000 in deposits. Today Reserve Banks ensure that all regions of the country have access to the Fed that regional economic interests are reflected in national policymaking and that the public has a voice in central bank affairs.

Track and manage nations currency. Melzer wrote when he was President of the Federal Reserve Bank of St. All depository institutions commercial banks savings institutions credit unions and foreign banking entities are required to hold reserves against certain types of deposits that they report as liabilities on their balance sheets.

A regional bank operating under and implementing the policies of the US Federal Reserve. Banks on Wednesday the settlement date for meeting reserve requirements as mandated by the. For example if a financial institution holds 1000000 in deposits and the reserve ratio is set at 10 then the minimum cash reserve the financial institution needs to maintain is 100000 1000000 10.

Name three activities you might see at Reserve banks. Distributing paper money to chartered depository institutions is another one of the Reserve Banks duties. We process checks wire transfers and ACH automated clearing house payments and distribute coin and currency Thomas C.

Bank reserves on the other hand are part of the banks assets. The Federal Reserves reserve requirement is 10 which means that Bank XYZ must keep at least 40000000 in an account at a Federal Reserve bank and may not use that cash for lending or any other purpose. Borrowers receive loans from banks and repay the loans with interest.

Mark 3 c Suggest ways that you might utilize to ensure that proper time is spent on Quadrant 2 activities so that stress is avoided. In a banks annual report bank. By formulating monetary policy.

A Describe Coveys Quadrant 2. How most people see the banking system its wrong. Ways to decrease risks include diversifying assets using prudent practices when underwriting and improving operating systems.

Central bank responsible for supervising banks and setting monetary policy to control inflation reduce unemployment and provide for moderate lending rates. Try to come up with policies to help 3. In turn banks return money to savers in the form of withdrawals which also include interest payments from banks to savers.

Offer short term loans to banks 2. For example the Federal Reserve is the US. By supervising financial institutions.

Supervise the implementation of the Federal Reserves monetary policy. By providing payments services. Stabilise the dividend rate.

Finally Reserve banks conduct research on the national and regional economies prepare Reserve bank presidents. One of the biggest areas of confusion for the average person is how bank reserves actually work. A bank reserve is a portion of a banks deposits that are set aside in a liquid account to ensure that the bank has enough cash on hand to fulfill withdrawal requests.

As banks for the US. Through the work of. Minimum cash reserves are generally set as a fixed percentage of a banks deposits and can be calculated using the reserve ratio.

Federal Reserve Banks distribute currency and coin to banks lend money to banks and process electronic payments. Mark 2 b List three of your work activities that should belong in Coveys Quadrant 2. The major risks faced by banks include credit operational market and liquidity risks.

Processing US Treasury payments conducting and disseminating info on national and regional economies processing and settling commercial banks checks and electronic payments. Last-minute buying and selling of eligible reserves that takes place between US. Kattyahto8 and 9 more users found this answer helpful.

Collect and analyze data to be used by the Federal Reserve Board FRB or the Federal Open Market Committee FOMC. Much like the boards of directors of private corporations Reserve Bank boards are responsible for overseeing their Banks administration and governance reviewing the Banks budget and overall performance overseeing the Banks audit process and developing broad strategic goals and directions. Government Reserve banks process the Treasurys payments sell its securities and assist with its cash management and investment activities.

Savers place deposits with banks and then receive interest payments and withdraw money. Provide financial services and lend money to regional banks within its district. At one point workers paychecks and the checks written to pay mortgages and most other bills were sent to one of the 12 Reserve Banks where the checks were processed to settle the debt.

At present reserve requirements aid in the. We also act as banker to the US. In bookkeeping reserves are ordinarily part of the equity of a company.

They do this in three ways. Every district has three main responsibilities. So in this article I reveal the following.

Prudent risk management can help banks improve profits as they sustain fewer losses on loans and investments. They provide very basic and familiar banking services. Thats right banks are no longer required to have any reserves whatsoever.

This reserve is recorded in the profit and loss account and can be used the following way. Servicing Depository Institutions. The theory was taken further with Stephen Coveys Time management matrix.

Revenue reserve is a portion of profit owned by the company and is kept aside for the use of other multiple purposes.

What Is The Fed Structure Education

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Role_of_the_Fed_Jun_2020-01-02efe1c99128421195f2a3c68737d792.jpg)

Federal Reserve System Frs Definition

No comments for "Name Three Activities You Might See at Reserve Banks."

Post a Comment